spy vs jepi|is jepi a safe etf : Clark Check out the side-by-side comparison table of JEPI vs. SPY. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that . 25 de jun. de 2022 · Clique agora para baixar e ouvir grátis WASHINGTON BRASILEIRO- CD.NOVO 2023! postado por maelcdsG em 25/06/22 às 15:14, e que já está com 5404 .

0 · spyi vs jepi etf

1 · spy vs jepi stocks

2 · reviews of jepi etf

3 · jepi uk equivalent

4 · jepi sharpe ratio

5 · is jepi a safe etf

6 · how risky is jepi

7 · how are spyi dividends taxed

8 · More

See new Tweets. twitch.tv/notaesthetical.Joined January 2019. 147. 584.6K. hannah owo (she/they) hannah owo (she/they) hannah owo (she/they) hannah owo (she/they) hannah .

spy vs jepi*******Compare ETFs SPY and JEPI on performance, AUM, flows, holdings, costs and ESG ratings.

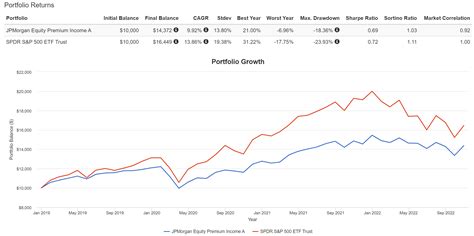

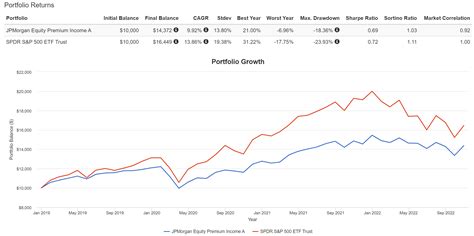

Check out the side-by-side comparison table of JEPI vs. SPY. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that .is jepi a safe etf Compare JPMorgan Equity Premium Income ETF JEPI and SPDR S&P 500 ETF Trust SPY. Get comparison charts for tons of financial metrics!

Compare NEOS S&P 500 High Income ETF SPYI and JPMorgan Equity Premium Income ETF JEPI. Get comparison charts for tons of financial metrics! JEPI and SPY: Basic information. Both JEPI and SPY are benchmarked against the S&P 500 index, and both hold large-cap stocks. And many of their holdings overlap, as to be elaborated on. Neos S&P 500(R) High Income ETF (SPYI) vs. JPMorgan Equity Premium Income ETF (JEPI): which to choose for a high-income fund? Click here to read our comparison. JEPI and SPY: Basic information. Both JEPI and SPY are indexed with the S&P 500 index as the benchmark. Both hold large-cap stocks. SPY’s median market cap is $170.9 billion and JEPI’s is $103.

SPYI Outperforms Within Equity Income Category. JEPI brought in nearly $13 billion in net flows in 2023 in another monster year for options strategies. Since its . The fundamental strategy difference between JEPI and SPYI is rooted in how they approach options and their underlying equity exposure. JEPI employs a . One ETF, the JPMorgan Equity Premium Income ETF (JEPI) swelled to some $29 billon in AUM, with investors pouring inflows into it after noticing its massive monthly distributions and lower volatility.The chart below includes total return performance and yield, and SPY (which seeks to track the performance of the S&P 500 Index) can be used as a baseline reference. . SPYI vs JEPI, XYLD, DIVO, SPY (8/30/2022 - 05/31/2024) SPYI = NEOS S&P 500 High Income ETF | XYLD = Global X S&P 500 Covered Call ETF .

In 2023, SPYI generated total returns of 18.13% and price returns of 4.69%. JEPI’s total returns were 9.81% with price returns of 0.90% over the same period. SPYI remains a consistent .spy vs jepi is jepi a safe etf Summary. ProShares S&P 500 High Income ETF (ISPY) offers enhanced income compared to SPDR S&P 500 ETF (SPY). That ETF is reviewed in detail. JPMorgan Equity Premium Income ETF (JEPI) would be . SPYI vs. JEPI - Volatility Comparison. The current volatility for NEOS S&P 500 High Income ETF (SPYI) is 1.07%, while JPMorgan Equity Premium Income ETF (JEPI) has a volatility of 1.72%. This indicates that SPYI experiences smaller price fluctuations and is considered to be less risky than JEPI based on this measure. SPY has more net assets: 525B vs. JEPI (33.7B). SPY has a higher annual dividend yield than JEPI : SPY ( 14.915 ) vs JEPI ( 4.862 ) . JEPI was incepted earlier than SPY : JEPI ( 4 years ) vs SPY ( 31 years ) . However, using JEPI as a reasonable proxy for it, this strategy has also trailed the market over a three-year time frame with a total return of 11.5% versus a 13.7% return for VOO. JEPI is fairly .

Since its inception in May 2020, JEPI has nearly matched the performance of the S&P 500, returning a total of 44% vs. a 47% gain for the SPDR S&P 500 ETF (SPY). That may not sound impressive on . The index ISPY tracks, the S&P 500 Daily Covered Call Index, went live on Oct. 5, and through Jan. 5 it has gained 9.5%, which compares to an 11% gain for the S&P and a 4.5% gain for the .

In 2023, SPYI generated total returns of 18.13% and price returns of 4.69%. JEPI’s total returns were 9.81% with price returns of 0.90% over the same period. SPYI remains a consistent .

Since last October when SPYI launched JEPQ has had better growth and larger dividends for a lower price and expense ratio. If you look at the past year (ish) performance JEPQ>SPYI>JEPI however JEPQ tracks the Nasdaq-100 index and JEPI tracks the s&p 500. Right now the Nasdaq-100 is outperforming the s&p 500 but that could change. " JEPI certainly achieved this, as the price of their shares only slipped -7.8% during the -10% drawdown the S&P 500 experienced between the months of August and October of 2023.The 5 year total return compound annual growth rate for JEPI stock is 12.56%. What is the YTD total return for SPDR S&P 500 ETF Trust (SPY)? The YTD total return for SPY stock is 14.92%. What is the TTM total return for SPDR S&P 500 ETF Trust (SPY)? The TTM total return for SPY stock is 26.54%. In 2023, SPYI generated total returns of 18.13% and price returns of 4.69%. JEPI’s total returns were 9.81% with price returns of 0.90% over the same period. SPYI remains a consistent .Since last October when SPYI launched JEPQ has had better growth and larger dividends for a lower price and expense ratio. If you look at the past year (ish) performance JEPQ>SPYI>JEPI however JEPQ tracks the Nasdaq-100 index and JEPI tracks the s&p 500. Right now the Nasdaq-100 is outperforming the s&p 500 but that could change. " JEPI certainly achieved this, as the price of their shares only slipped -7.8% during the -10% drawdown the S&P 500 experienced between the months of August and October of 2023.

The 5 year total return compound annual growth rate for JEPI stock is 12.56%. What is the YTD total return for SPDR S&P 500 ETF Trust (SPY)? The YTD total return for SPY stock is 14.92%. What is the TTM total return for SPDR S&P 500 ETF Trust (SPY)? The TTM total return for SPY stock is 26.54%.Compare ETFs JEPI and SPY on performance, AUM, flows, holdings, costs and ESG ratings

spy vs jepiApples and Oranges. JEPI is an income play with limited growth potential. SPY is the first, largest and the most liquid ETF. JEPI has about 7% yield while SPY is little more than 1%. I DRIP JEPI for future income and I buy SPY on drips with an eventual plan to sell covered calls for income. - SPY up 5.3%, while JEPI up less at 2.4% - JEPI recent dividends were lower, SA showing yield only 6.95% . Lower yield something to watch. With little price return, if JEPI's covered call method .Holdings. Compare ETFs ISPY and JEPI on performance, AUM, flows, holdings, costs and ESG ratings.Accounting Flag (%) Performance. In addition to weekly, YTD and yearly returns, this section features the ETF’s beta, P/E ratio, dividend data, and risk metrics. Risk adjusted return comparisons can be made with the help of beta and standard deviation on this page. JEPI. JEPY. 1 Week Return. 0.39%.In the past year, JEPI returned a total of 12.08%, which is significantly lower than JEPQ's 27.84% return. These numbers are adjusted for stock splits and include dividends. Symbol SPYD vs. JEPI - Volatility Comparison. SPDR Portfolio S&P 500 High Dividend ETF (SPYD) has a higher volatility of 3.88% compared to JPMorgan Equity Premium Income ETF (JEPI) at 1.77%. This indicates that SPYD's price experiences larger fluctuations and is considered to be riskier than JEPI based on this measure.Compare ETFs JEPI and SPYI on performance, AUM, flows, holdings, costs and ESG ratings

Suas origens remontam ao final do século 19 no Rio de Janeiro. O Deunoposte modernizou o Jogo do Bicho ao trazer essa loteria centenária para o ambiente online. Seu site e aplicativos permitem que apostadores de todo o Brasil façam suas “fezinhas” nos 25 animais de forma fácil e segura, com acesso aos resultados em tempo real.

spy vs jepi|is jepi a safe etf